PHARMACEUTICAL MARKET IN POLAND

OVERVIEW, TRENDS AND GROWTH PROSPECTS

The pharmaceutical market in Poland is influenced by global trends, changes introduced at the EU level, as well as internal regulations and developments.

A steady growth in spending on health protection globally is driven by growing demand related to population ageing and higher incidence rate of chronic diseases, and on the other hand − by medical progress and increased spending on innovation. Against this backdrop, cost pressure and a focus on seeking efficiency in public spending became the main factors shaping the global healthcare market. The governments’ role is becoming increasingly significant with their influence on prices and reimbursement levels. At the same time, the scale of operations on the market is growing – large players are consolidating and competition is on the rise, also for the best professionals.

On the one hand, all these changes are intended to enhance drugs availability for patients and improve the security of their supply; on the other hand, though, they lead to imposition of new obligations and cost burdens on pharmaceutical distributors.

Changes on the Polish pharmaceutical market gained momentum following the entry into force, as of January 1st 2012, of the new Act on Reimbursement of Drugs, Foodstuffs Intended for Particular Nutritional Uses and Medical Devices (called the ‘Reimbursement Act’) and accompanying amendments to the Pharmaceutical Law. The new Act introduced a number of changes, including regulated fixed selling prices, fixed wholesale margins, and standardised method for calculating retail margins on reimbursable drugs, a ban on any sale incentive systems for reimbursable drugs, a new method for calculating limits for patient cost sharing in different limit groups, and making the amount of reimbursement contingent on the cost and time of drug therapy.

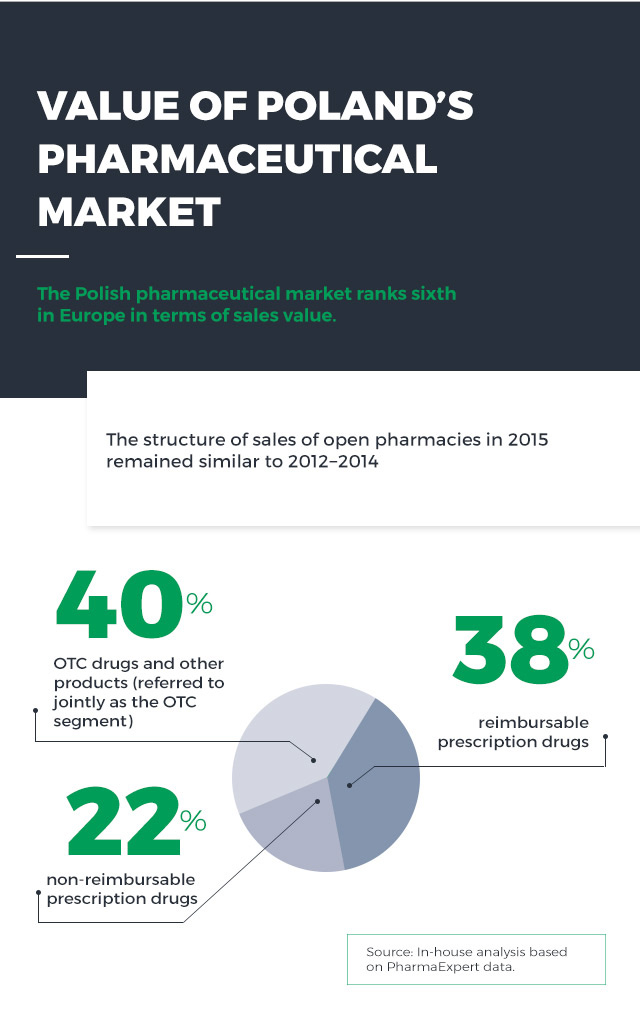

A noteworthy fact is that the Reimbursement Act has actually had an adverse effect on patients − the patient co-payment rate has increased and is now among Europe’s highest. Thus, the share of public drug reimbursement in the overall spending on drugs in Poland is very low. The situation is further aggravated by other barriers to access to medication, caused, among other factors, by a ban on pharmacy advertisement (introduced by the Pharmaceutical Law and effective as of January 1st 2012), which due to its broad interpretation not only prevents access to information about drugs and their availability for patients, but also rules out the use of innovative solutions to facilitate drug purchases. In 2015, however, plans were announced to improve the situation of patients, especially with respect to the quality, availability and safety of pharmacotherapy. These measures include full reimbursement of selected drugs for patients above 75 years of age and the concept of a systemic approach to pharmaceutical care.

The table below presents the main challenges faced by companies operating on the Polish pharmaceutical market:

Despite the challenging legal environment, the pharmaceutical market in Poland has a strong growth potential driven by the population ageing and higher incidence rate of lifestyle and chronic diseases. In addition, there is an overall trend towards the narrowing of differences in the standard of living and health expenditure between Poland and Western European countries, where the healthcare spending is several times higher. On top of that, Poles are becoming increasingly aware of health-related matters and buy more drugs for disease prevention.

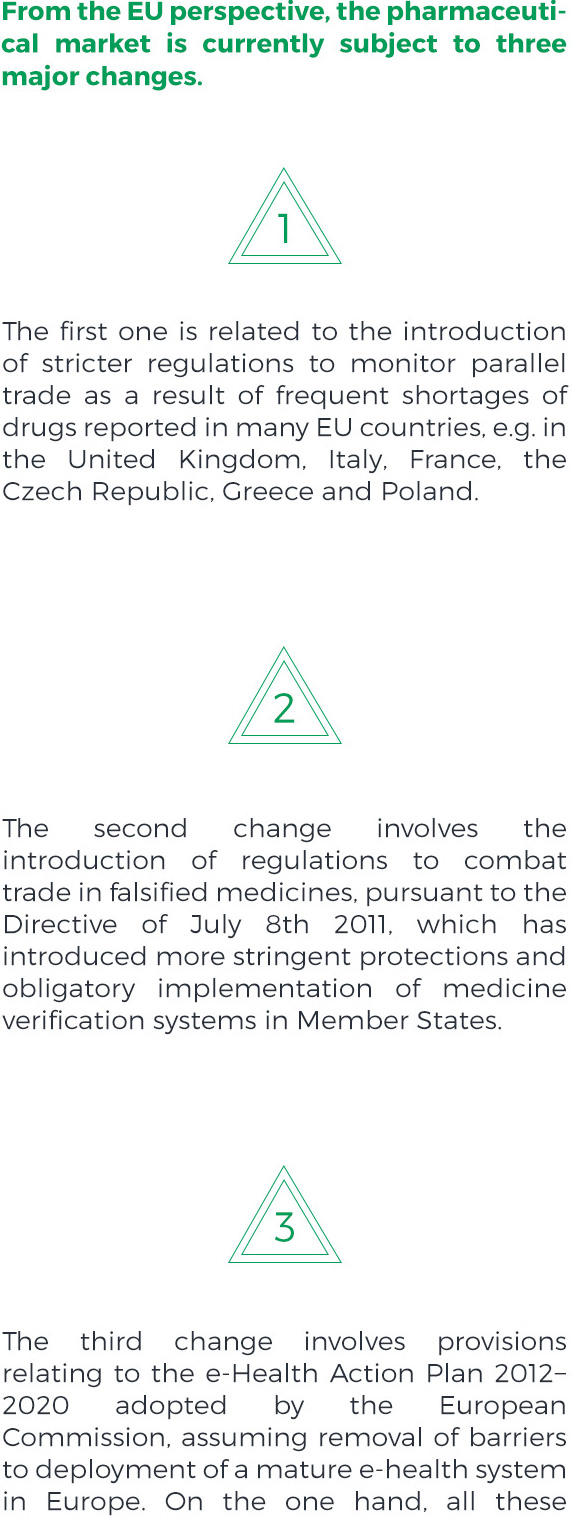

It should be noted that in 2011 reimbursable prescription drugs represented a major share of the market (45%), with non-reimbursable prescription drugs and the OTC segment accounting for 19% and 36%, respectively. The entry into force of the new Reimbursement Act marked a permanent change in the market structure – which is unfavourable for patients, as the average patient co-payment rate has increased.

Average drug cost sharing between reimbursement and patient co-payment

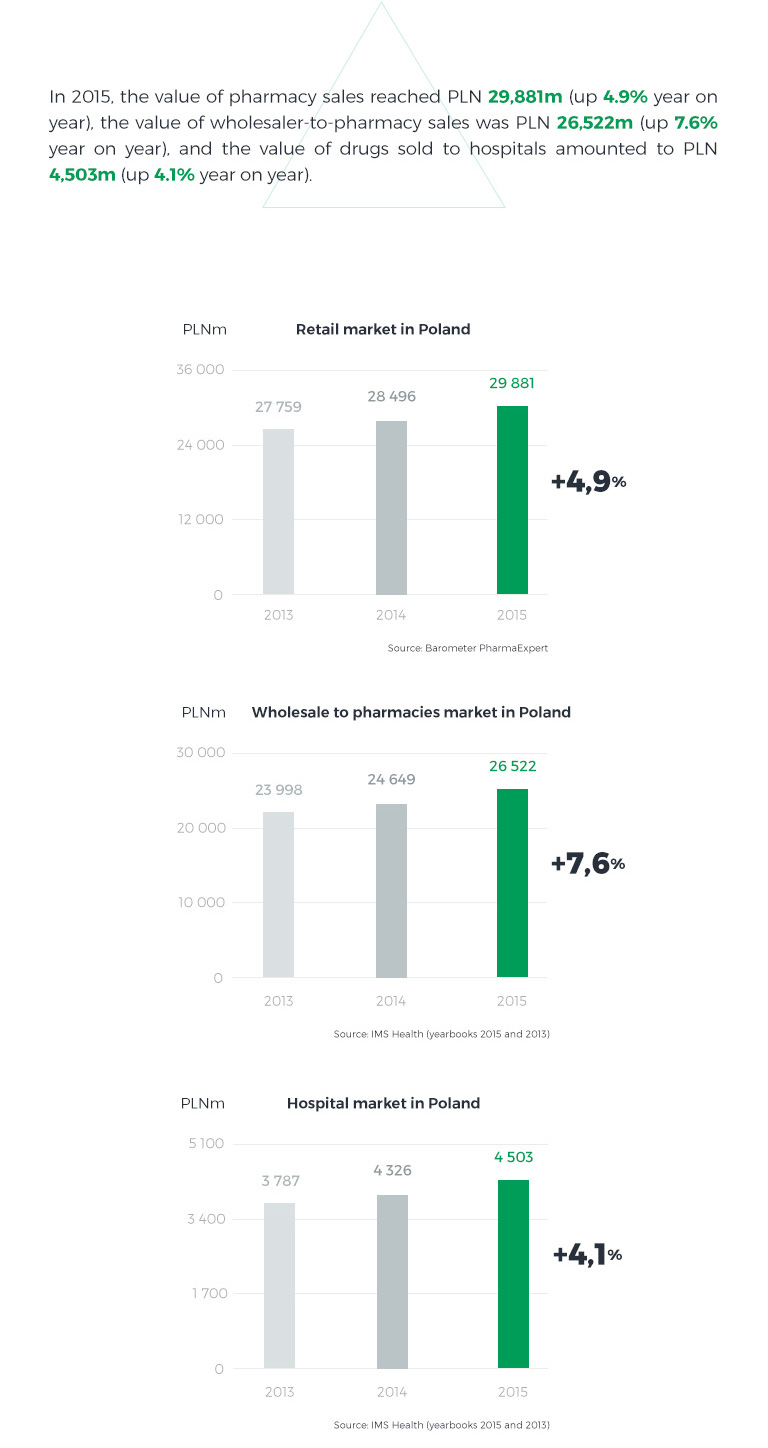

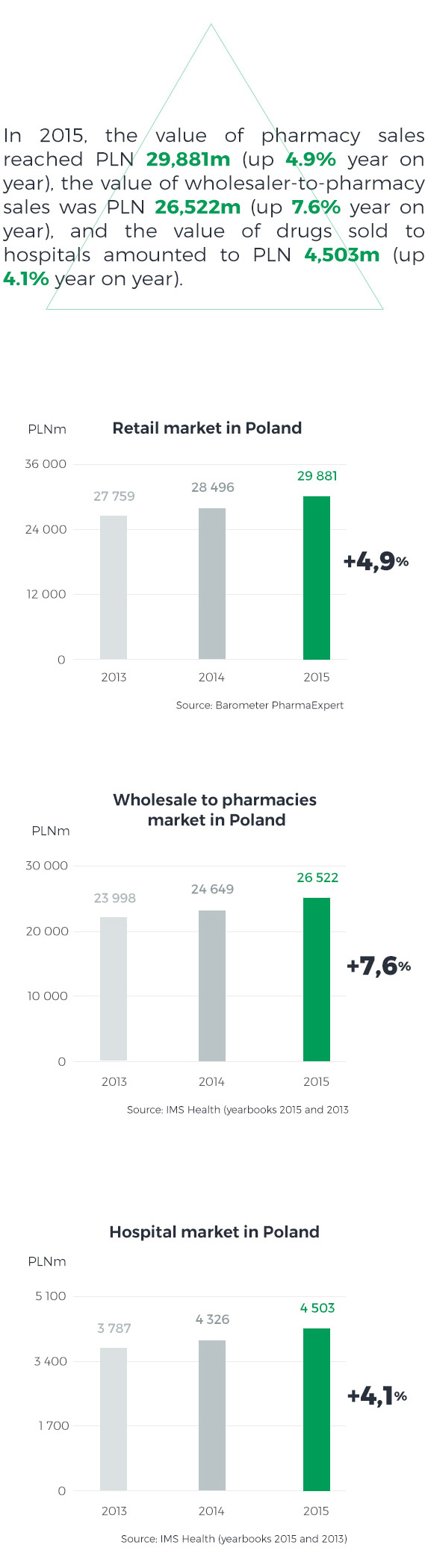

The size of Poland’s pharmaceutical market may the determined at three different levels:

- sales from manufacturers to wholesalers – value at manufacturer’s net prices,

- sales from wholesalers to pharmacies – value at net wholesale prices,

- sales from pharmacies to patients – value at retail prices.

One segment of the market is sales to hospital pharmacies, which buy drugs from wholesalers and directly from manufacturers.

In 2015, unlike in previous years, the pharmacy market grew faster than the hospital market. The growth was driven by an exceptionally high infection incidence rate in Q1 2015 and the resulting increase in sales of both prescription and OTC drugs. A few years on from the introduction of the Reimbursement Act, the reimbursable drugs market has stabilised, with selling prices rather rigid in negotiations. The pharmacy market’s value is also affected by the number and structure of pharmacies and changes they undergo. At the close of 2015, there were approximately 14.5 thousand pharmacies in Poland, which represents an increase of nearly 250 year on year. 37% of them were networked pharmacies accounting for 47% of total sales value, and 63% were standalone pharmacies with a 53% share in total sales.

PHARMACEUTICAL MARKET IN LITUANIA

OVERVIEW, TRENDS AND GROWTH PROSPECTS

The Lithuanian pharmaceutical market is the twelfth largest market in Central and Eastern Europe (according to BMI). On the one hand, the small size of the Lithuanian population puts a bar on any strong long-term growth of the country’s pharmaceutical market; on the other hand, however, its predictability and limited risks have driven the growth rate up to a solid single-digit figure over the past several years, and the CAGR until 2018 is expected at 3.7% (according to BMI). The Lithuanian market is home to 1,300 pharmacies and is highly consolidated – the top four players control 80% of all Lithuanian pharmacies and hold an 85% market share. Hence, the market participants focus on improving their competitive positions and developing value-added services for patients. Furthermore, entities operating on the Lithuanian market will soon face challenges coming from proposed amendments to the Pharmaceutical Law, designed to enable entities other than pharmacies (i.e. shops, service stations, other retailers) to sell OTC drugs, the need to regulate online drugs sales, and the introduction of the payment card industry data security standard (PCI DSS).

Created by John Pitcher