A statement of compliance with

corporate governance rules

Pursuant to the Minister of Finance’s Regulation on current and periodic information to be published by issuers of securities and conditions for recognition as equivalent of information whose disclosure is required under the laws of a non-member state, dated February 19th 2009 (Dz.U. of 2009 No. 33, item 259), and in light of the resolutions passed by the Supervisory Board of the Warsaw Stock Exchange on the Code of Best Practice for WSE Listed Companies, the Management Board of Pelion S.A. (the Company) provides a statement of compliance with corporate governance rules in 2015.

The code of corporate governance principles adopted by the Company and places where the text of the code is publicly available

In 2015, the Company complied with corporate governance principles for listed companies, as specified in appendix to Resolution No. 19/1307/2012 of the WSE Supervisory Board, dated November 21st 2012: ‘Code of Best Practice for WSE Listed Companies’ (‘Code of Best Practice’). The text of the Code is available on the WSE’s website (direct link: www.gpw.pl/dobre_praktyki_spolek_regulacje) and on the Company’s website: www.pelion.eu in the ‘Best Practices’ section. Pursuant to Resolution No. 27/1414//2015 of the WSE Supervisory Board dated October 13th 2015, a new Code of Best Practice came into force as of January 1st 2016. The Company issued EBI Current Report No. 1/2016 on the scope of application of the new Code of Best Practice and published information on its compliance with the Code on its website.

Corporate governance principles with which the Company did not comply and reasons for non-compliance

In 2015, the Company complied with the principles set out in the Code of Best Practice, attached as an Appendix to the WSE Supervisory Board Resolution No. 19/1307/2012 of November 21st 2012, except for the provision of Section III.6 on meeting the independence criteria by at least two members of the Supervisory Board: on April 21st 2015, the Company’s General Meeting elected five members of the Supervisory Board, two of whom met the independence criteria. As of September 19th 2015, one of them ceased to meet the criteria of independence as defined in 1.(h) of Annex II to the Commission Recommendation 2005/162/EC of February 15th 2005 on the profile of independent non-executive or supervisory directors. The information on failure to meet the independence criteria by at least two members of the Supervisory Board was published in the Company’s EBI report No. 1/2016.

Key characteristics of the internal audit and risk management systems related to the preparation of separate and consolidated financial statements

The internal audit system of the Pelion Group facilitates the implementation of the mission and objectives of the Group companies. It also helps to achieve long-term profitability goals and maintain the accuracy of financial and management reporting. The internal audit system comprises a range of audit procedures, establishes the division of tasks and responsibilities, and serves to identify and assess risks which may have a bearing on the achievement of objectives.

Pelion S.A. has implemented the Group’s internal audit rules which set out audit standards and define the key responsibilities and tasks of the audit function. The Company is in the process of implementing an integrated risk management system, based on three pillars:

- internal functional audit performed by risk owners through risk management at the organisational unit and/or process level,

- risk management support structures under which tasks are performed by risk management process owners (owners of the following processes: quality, information security, physical security, controlling, monitoring and debt collection),

- institutional audit performed by internal audit department, monitoring of risk management and independent assessment of the risk management adequacy.

The internal functional audit is performed by the Company’s Management Board, heads of entities owned by the Pelion Group and employees according to their respective scopes of duties. Structuring of the functional audit involves specifying and developing audit mechanisms, divided into ‘current’ audit and ‘ex-post’ audit, including ‘planned ex-post’ audit. Current audit comprises practically applied, formally described mechanisms, organisational solutions and controls which work mainly as a preventive measure and whose role is to prevent the Group entities from making mistakes in the course of transactions. Ex-post audit consists of controls the aim of which is to check the consistency of actions taken against what is required after their completion. The audit mechanisms are supported by the implemented organisational model for ex-post functional audits, including for the planning by the Group companies of audits covering periodically identified key process risks. Every year, the Pelion Group companies design, in cooperation with the internal audit department, special check tests to be performed by the companies in selected areas of their operations. A system was also created to monitor the performance of those tests, including a system of reporting test results to the internal audit department. The scope of entities to be covered by the planned ex-post audit system is determined by the Pelion Management Board, which indicates the Group companies to be covered by the system.

The internal institutional audit is performed by the internal audit department based on cooperation agreements with the Group companies, a set of internal rules prepared based on the International Standards for the Professional Practice of Internal Auditing, and other international professional standards, in particular the standards adopted by the Institute of Internal Auditors (IIA). The audit department reports to the President of the Management Board of Pelion S.A.

The responsibilities of Pelion S.A.’s internal audit department include first of all the evaluation of efficiency of the risk management and internal audit procedures. The audit department makes the necessary adjustments to the audit mechanisms, seeking to improve efficiency and security of the Group companies by performing assurance and advisory tasks.

Audit tasks are planned each year, for periods covering several years. Planning is performed based on the results of risk review carried out by the audit department for the entire Group, and based on the risk management systems used by the Group companies to address risks in their key operating areas and processes. The audit department fulfils its responsibilities also through its involvement in the planning of functional audit check tests, as well as monitoring and organising the process of reporting test results. Thus, the audit department is involved in exercising supervision over the quality and effectiveness of the ex-post functional audit system.

The annual and long-term audit plans for the Pelion Group are subject to approval by the Management Board of Pelion S.A., as well as its Supervisory Board, which may request that the plans be changed or supplemented. Audit plans for the individual Group companies are also approved by their respective heads and Supervisory Boards, and form an element of the Group’s general audit plan.

The results and effectiveness of internal audits are reported both to the Management Board and the Supervisory Board of Pelion S.A. through the Supervisory Board Audit Team, and to the Management and Supervisory Boards of the audited companies. The Management Board and the Supervisory Board of Pelion S.A. monitor the implementation of instructions and recommendations issued by the internal audit department, which attaches special importance to testing the control mechanisms designed to reduce the risk of misconduct. Every year, the audit department − both for the purposes of functional audit and as part of its audit tasks − assesses the organisation’s resilience to misconduct, evaluates the preventive control mechanisms, and prepares tests to detect risks in selected areas of the Group’s operations.

The information flow within the Company enables preparation of up-to-date, complete, and reliable financial reports which comply with the regulations and accounting policies approved by the Management Board. In 2015, the accounting records of the Group companies were maintained by:

- Business Support Solution S.A. (BSS S.A.), which maintained the records and prepared the financial statements for all the Group companies, except the Lithuanian subsidiaries,

- individual Lithuanian subsidiaries within their organisational structures, except for UAB Nofros vaistine, which engaged a third party to keep its accounting records.

Preparation of consolidated financial statements was also assigned to BSS S.A., which follows its own control procedures in this respect.

In order to ensure effectiveness of the internal audit and risk management system used for the purposes of financial reporting, the Company’s Management Board has adopted and approved:

- accounting policies of Pelion S.A.,

- IFRS-compliant accounting policies for the purposes of consolidated financial statements of the Pelion Group,

- inventory-taking procedure,

- documents regarding the IT system for accounting data processing,

- internal audit rules along with instructions, orders and internal procedures.

Additionally, Pelion S.A., BSS S.A. and the Lithuanian subsidiaries apply a number of other rules for the audit system as well as the identification and assessment of risks related to the Company’s operations, such as:

- entering accounting records based solely on correct and approved documents,

- reviewing the documents in terms of their formal, accounting and substantive correctness,

- reconciliation of data periodically on a regular basis,

- review of the Company’s assets by means of inventory-taking and measurement of assets, equity and liabilities for the purposes of reporting as at each reporting date,

- authorisation system (approval and authorisation of transactions within or above pre-defined limits by authorised persons),

- reconciliation system (verification of transaction details, balance reconciliation),

- work schedules (allowing for schedule flexibility),

- multi-level accounting management process (mitigating the moral risk in financial reporting).

The Company’s accounting records are maintained using the Oracle e-Business Suite and Asseco (in Poland) and Medinfo and WMS (in Lithuania) integrated IT systems. The systems ensure clear division of responsibility, consistency of records, and ongoing checking of the accounting records. The systems are password-protected against unauthorised access, and have functional access control. The specifications of the IT systems meet the requirements set out in Art. 10.1.3c of the Accountancy Act of September 29th 1994. Financial reporting is carried out using the Hyperion system. The key principle of IT systems management is data security, which is achieved by multi-level authorisation of system users, access control and creation of backup copies.

Access to databases of the IT systems is controlled through appropriate employee authorisations. Access to the software is controlled at each stage of preparing financial statements, from source data input, through data processing, to final information output. The system is independently monitored and supported with appropriate contingency solutions. The Group companies have in place the necessary procedures for data backup and system recovery.

The internal audit system enables identification and mitigation of major risks, such as abuse, irregularities, and losses. The Group continuously monitors certain pre-defined parameters and tracks changes in business indicators, such as inventory cycle or the average collection period.

Processes are continuously reviewed at Group companies to identify adequate management procedures. The efficacy of the internal audit and risk management procedures applied in financial reporting is reflected by the high quality of the financial statements, as confirmed by qualified auditors’ opinions.

Another component of the internal audit system is the audit of financial statements by independent auditors. They are responsible for auditing the full-year separate and consolidated financial statements and reviewing the half-year separate and consolidated financial statements. The Supervisory Board appoints the auditor from among recognised audit firms which submitted their proposals in the bidding process.

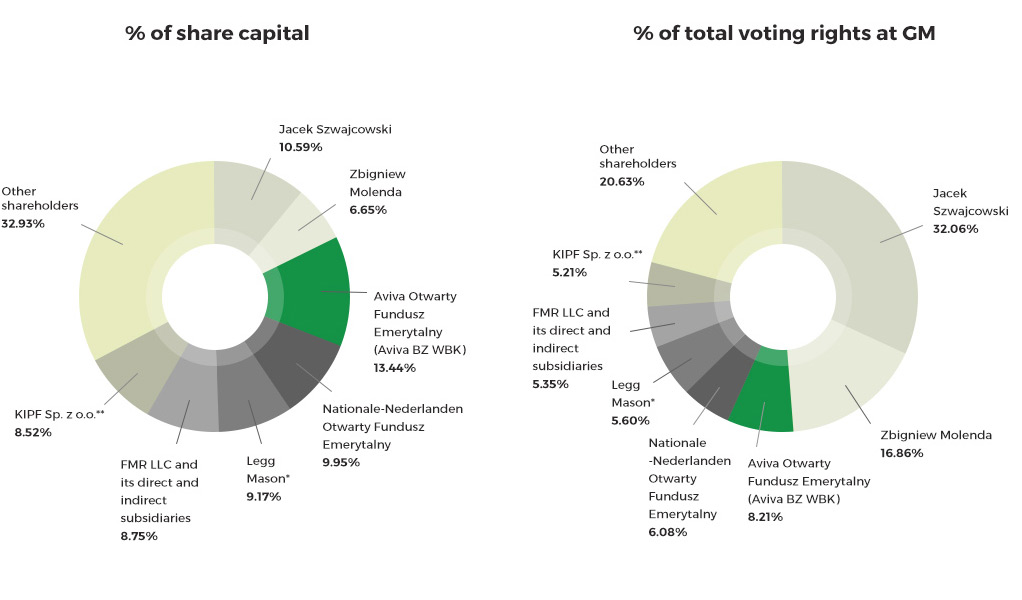

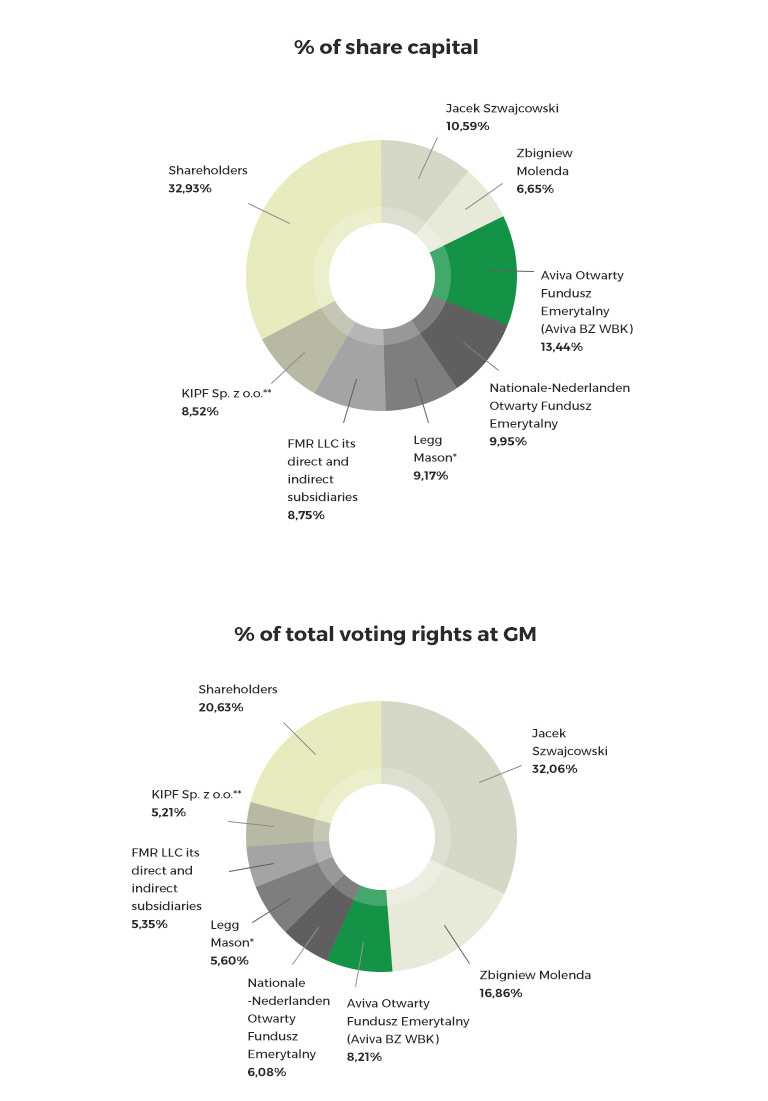

Major holdings of Pelion shares

The table below presents the shareholders holding, directly or indirectly through a subsidiary, 5% or more of total voting rights at the General Meeting of Pelion S.A. as at December 31st 2015 (based on the information available to the Company):

Holders of securities which confer special control powers anddescription of such powers

The existing shareholders do not hold any voting rights at the General Meeting other than those attached to Pelion shares.

Pelion S.A. issued 1,773,300 preference shares (voting preference: each share confers the right to five votes).

As at December 31st 2015, 1,773,300 Series A, B, C and F shares were shares with voting preference: each share conferred the right to five votes.

The holders of preference shares are Mr Jacek Szwajcowski (1,166,700), Mr Zbigniew Molenda (583,300) and Mr Ignacy Przystalski (23,300).

Restrictions on the exercise of voting rights attached to Company shares

There are no restrictions on the exercise of voting rights attached to Company shares.

Restrictions on transferability of Company securities

Save for restrictions stipulated by the laws of general application, no restrictions (including in particular contractual restrictions) apply to the transferability of Company shares.

Rules governing appointment and dismissal of management staff; the management’s powers, including the right to decide on the issue or buyback of shares

Art. 14 of the Company’s Articles of Association provides for the power of the Supervisory Board to appoint, remove and determine the number of members of the Management Board and define the Rules of Procedure for the Management Board, as well as for a three-year term of office of the Management Board and the joint representation principle.

The Supervisory Board appoints the president of the Management Board from among the candidates nominated by the Supervisory Board members.

At the request of the president of the Management Board, the Supervisory Board determines the number of the Management Board members, including vice-presidents, and appoints other members of the Management Board. Members of the Supervisory Board may propose the number of the Management Board members as well as candidates for the Management Board members. Representations may be made and signatures affixed on behalf of the Company by two members of the Management Board acting jointly.

Detailed procedures for the Management Board are set out in its Rules of Procedure (the current Rules of Procedure are available at www.pelion.eu).

The General Meeting decides on the issue or buyback of shares.

Rules governing amendments to the Company’s Articles of Association

In order to amend the Company’s Articles of Association, a resolution by the General Meeting and an entry in the relevant registry are required. A detailed procedure for adoption of resolutions concerning amendments to the Company’s Articles of Association is governed by the applicable laws, the Rules of Procedure for the General Meeting, and Company’s Articles of Association.

On April 21st 2015, the Annual General Meeting of the Company resolved to amend the Company’s Articles of Association in the following manner:

- Art. 6 was amended to read as follows: “The Company’s share capital shall amount to no less than PLN 22,291,428 (twenty-two million, two hundred and ninety-one thousand, four hundred and twenty-eight złoty) and no more than PLN 24,398,628 (twenty-four million, three hundred and ninety-eight thousand, six hundred and twenty-eight złoty), and shall be divided into no less than 11,145,714 (eleven million, one hundred and forty-five thousand, seven hundred and fourteen) and no more than 12,199,314 (twelve million, one hundred and ninety-nine thousand, three hundred and fourteen) shares with a par value of PLN 2 (two złoty) per share.”

- Art. 7.1 was amended to read as follows: “The Company’s share capital shall comprise a total of 1,773,300 (one million, seven hundred and seventy-three thousand, three hundred) registered shares and a total of 9,372,414 (nine million, three hundred and seventy-two thousand, four hundred and fourteen) bearer shares.”

- Art. 12.4 was amended to read as follows: “The Company shall enable its Shareholders to participate in General Meetings by electronic means of communication, in the form of:

- real-time transmission of General Meetings,

- bilateral, real-time communication allowing shareholders to take the floor during a General Meeting from a location other than the General Meeting’s venue.”

Procedures and powers of the General Meeting, shareholders’ rights, and the procedure for their exercise, as set forth in the Rules of Procedure for the General Meeting, unless such procedures powers, and rights are clearly defined in the applicable laws

The proceedings of the General Meeting are broadcast via the Company’ s website (www.pelion.eu).

Art. 12 of the Company’s Articles of Association defines the powers of the General Meeting, which have been sourced from the Commercial Companies Code verbatim or modified to the extent permitted by the Code and consistent with the corporate governance principles.

The powers of the General Meeting include:

- review and approval of the Director’s Report on the Company’s operations and the financial statements for the previous financial year, and granting approval of the discharge of duties by members of the Company’s governing bodies;

- distribution of the profit earned or coverage of the loss incurred by the Company in the previous financial year;

- adoption of a resolution concerning the Company’s continuing as a going concern if the balance sheet prepared by the Management Board shows a loss which exceeds the sum of the reserve funds and the capital reserve;

- taking a decision concerning claims for redress of damage inflicted when establishing the Company or in connection with its management or supervision;

- sale or lease of, or creation of limited property rights in, the Company’s business or its organised part;

- acquisition or disposal of property or perpetual usufruct right to property, or of an interest in property or in perpetual usufruct right to property, if the value of a single transaction exceeds 10% of the Company’s equity as disclosed in the most recent balance sheet; in all other cases the decision whether to grant consent to the acquisition or disposal of property, perpetual usufruct right to property or of an interest in property or in perpetual usufruct right to property falls within the scope of competence of the Supervisory Board – if the value of a single transaction exceeds 5% of the Company’s equity as disclosed in the most recent balance sheet, or within the scope of competence of the Management Board – if the value of a single transaction is lower;

- issue of convertible bonds or bonds with pre-emptive rights;

- acquisition of own shares which are to be offered to the Company employees or persons who were employed at the Company or any of its related entities for at least three years;

- determination of the amount of remuneration payable to members of the Supervisory Board;

- appointment of an attorney-in-fact to represent the Company in agreements between the Company and individual members of the Management Board, in any disputes between the Company and such members, or in any disputes concerning cancellation or declaring invalidity of a resolution adopted by the General Meeting;

- cancelation of shares;

- amendments to the Company’s Articles of Association;

- change of the Company’s business profile;

- increase or reduction of the Company share capital;

- mandatory buyout of shares held by shareholders representing less than 5% of the share capital by no more than five shareholders holding jointly no less than 90% of the share capital;

- merger, division, transformation or dissolution of the Company;

- decision concerning the reversal of liquidation and continuation of the Company’s existence;

- other matters, as provided for in the law.

The manner of operation of the General Meeting is subject to the provisions of the Rules of Procedure for the General Meeting, which are in line with the Commercial Companies Code and corporate governance. The Rules govern procedural matters, whose detailed regulation ensures proper conduct of meetings and due respect for the shareholders’ rights.

The key matters covered by the Rules of Procedure include:

- adoption of a rule that the shareholders are provided with draft resolutions of the General Meeting prior to commencement of the Meeting;

- regulations concerning the presence at the General Meeting of persons other than the shareholders and members of the Supervisory or Management Boards;

- adoption of a rule that the General Meeting may not resolve to drop an issue from the agenda if it was included in the agenda at the request of a shareholder;

- adoption of rules governing the voting on amendments to draft resolutions;

- adoption of such rules of voting on the election of the Supervisory Board members which ensure that the number of its independent members is not limited to the minimum required by the Company’s Articles of Association or the principles of corporate governance;

- adoption of a rule providing for the election of Supervisory Board members in block voting.

The procedure for exercise of shareholder rights provided for in the law:

1) The right of a shareholder to request that a certain item be placed on the agenda of the General Meeting

A shareholder or shareholders representing at least one twentieth of the share capital may request that certain items be placed on the agenda of the General Meeting. Any such request should be submitted to the Management Board no later than twenty-one days prior to the scheduled date of the Meeting and should state the reasons for or contain a draft resolution concerning the proposed item. The request may be sent in writing, to the Company’s registered office address, or in electronic form to: walne_zgromadzenie@pelion.eu.

In order to identify the shareholders as persons entitled to submit such requests, registered certificates of deposit issued by a relevant entity and copies of identity documents confirming the identity of shareholders or their proxies (official identification document of the above persons, and a copy of registration documents or other documents confirming the right of given persons to represent a shareholder who is not a natural person), should be attached to the submitted request.

Any amendments to the agenda made upon a shareholder’s request are announced by the Management Board as soon as practicable but no later than eighteen days prior the scheduled date of the General Meeting The new agenda is published on the Company’s website.

2) The right of a shareholder to propose draft resolutions on matters which have been placed or are to be placed on the agenda prior to the scheduled date of the General Meeting

A shareholder or shareholders representing at least one twentieth of the share capital may submit draft resolutions, prior to the scheduled date the General Meeting, on matters which have been placed or which are to be placed on the agenda. The request may be sent in writing, to the Company’s registered office address, or in electronic form to: walne_zgromadzenie@pelion.eu.

The proposal should present the reasons for or contain a draft resolution concerning the proposed item of the agenda. Furthermore, shareholders who submit draft resolutions should present, in order to enable their identification as persons eligible to submit such requests, registered certificates of deposit issued by a relevant entity. Copies of identity documents confirming the identity of shareholders or their proxies (official identification document of the above persons, and a copy of registration documents or other documents confirming the right of given persons to represent a shareholder who is not a natural person), should be attached to the submitted proposal. The Company publishes draft resolutions submitted by shareholders on its website without undue delay.

3) The right of a shareholder to appoint a proxy, and manner of exercising the voting right through a proxy

A shareholder may attend the General Meeting and exercise voting rights in person or through a proxy. A proxy may exercise all the rights of a shareholder at the General Meeting unless the power of proxy stipulates otherwise. A proxy votes the shares held by a given shareholder and registered in one or more securities accounts in the same way, unless the power of proxy stipulates otherwise. If a shareholder appoints more than one proxy, it is assumed that the proxies exercise the voting rights acting jointly, unless the power of proxy stipulates otherwise. The power of proxy should be granted in writing or in electronic form. If the power of proxy is granted in electronic form, the shareholder must notify the Company of the same by sending an email to: walne_zgromadzenie@pelion.eu, after having delivered to the Company in writing the email address used to grant the power of proxy. If a shareholder fails to deliver the email address or fails to notify the Company that an electronic power of proxy have been granted by the shareholder, the proxy will not be admitted to attend the General Meeting.

Copies of documents confirming the identity of shareholders or their proxies (official identification document of the above persons, and a copy of registration documents or other documents confirming the right of given persons to represent a shareholder who is not a natural person), should be attached to the written notice that a power of proxy has been granted, or notice that a power of proxy has been granted sent in the electronic form, to enable the identification of the shareholder granting power of proxy in electronic form.

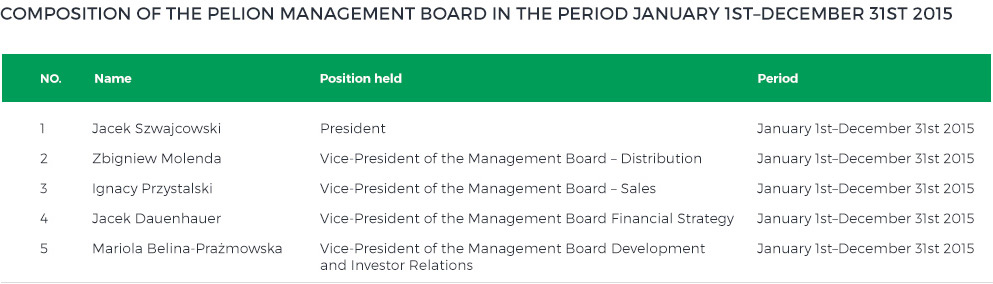

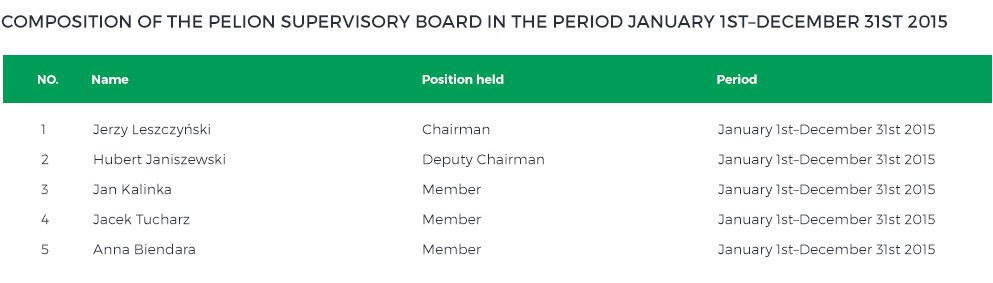

Composition and activities of the Company’s management, supervisory and administrative bodies or of their committees; changes in their composition in the last financial year

The Company applies Rules of Procedure for the Management Board of Pelion Spółka Akcyjna of Łódź, dated December 13th 2013 (the consolidated text of the Rules is available at www.pelion.eu).

The Management Board manages the Company’s affairs and represents the Company before third parties. All matters related to the management of the Company and not reserved to the other governing bodies under relevant laws or the Company’s Articles of Association fall within the scope of powers of the Management Board. Representations may be made and signatures affixed on behalf of the Company by two members of the Management Board acting jointly. Detailed procedures for the Management Board are defined in its Rules of Procedure.

The principal issues resolved in the Rules of Procedure include:

- division of tasks and duties, and the scope of Management Board members’ responsibilities related to the management of the Company’s business;

- rules governing the making of representations on behalf of the Company, including the signing of documents;

- matters which require the Management Board’s resolution;

- rules governing the convening and conducting of the Management Board’s meetings and adopting of resolutions;

- rules to be followed in the event of a conflict of interests.

Art. 13 of the Company’s Articles of Association stipulates the rules for appointment of members to the Supervisory Board, determines the Supervisory Board’s powers and defines its term of office (one year). The Company’s Articles of Association stipulate that at least three members of the Supervisory Board are elected from among candidates who:

- are not related to the Company, a shareholder or shareholders holding jointly 5% or more of the total vote at the General Meeting, a subsidiary of the Company or a subsidiary of the Company’s parent and the Company’s employee, in a way that could have material impact on the person’s ability to make impartial decisions;

- are not employees of the Company, its subsidiary or a subsidiary of the Company’s parent.

The Rules of Procedure for the Supervisory Board contain detailed stipulations concerning the operation of the Supervisory Board.

Key issues addressed by the Rules include:

- approval of the Company’s financial plans,

- appointment of the audit committee and of the nomination and remuneration committee,

- specification of matters with respect to which adoption of a resolution by the Supervisory Board should be preceded by an opinion of the appropriate committee;

- rules for convening and holding meetings,

- rules to be followed in the event of a conflict of interests;

- rules for the verification of representations confirming the independent status of a member of the Supervisory Board.

As at December 31st 2015, Mr Jacek Tucharz met the criteria of independence, in line with the criteria set out in Annex II to the Commission Recommendation 2005/162/EC of February 15th 2005 on the profile of independent non-executive or supervisory directors.

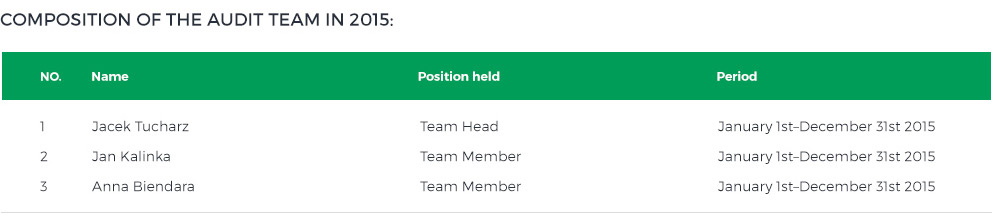

Audit Committee

Pursuant to Art. 86.3 of the Act on Auditors, Their Self-Government, Qualified Auditors of Financial Statements, and Public Supervision, dated May 7th 2009 (the ‘Act’), the responsibilities of an audit committee, as specified in the Act, were assigned to the Supervisory Board of Pelion S.A.

In 2015, the tasks of the Audit Committee were performed by the entire Supervisory Board, which appointed three of its members as the Audit Team. The Audit Team coordinates the work of the Supervisory Board performing the duties of an Audit Committee. As at December 31st 2015, one member of the Audit Team met the independence criteria, and two of its members were qualified in accounting and finance.

The responsibilities of the Audit Team, as the body performing the Supervisory Board’s audit duties, include:

- monitoring of the Company’s financial reporting and financial audit functions,

- monitoring internal control, internal audit and risk management systems,

- evaluation of qualifications and experience of external auditors, monitoring the auditors’ independence, and monitoring the audit process.

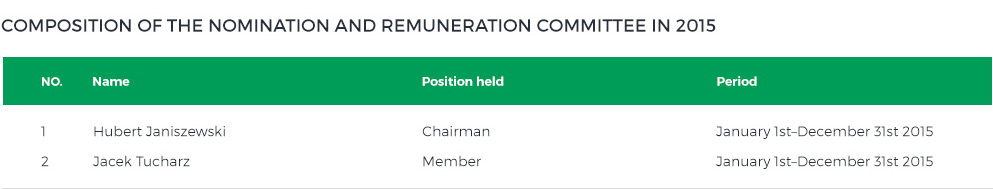

Nomination and Remuneration Committee

The Nomination and Remuneration Committee is composed of two members of the Supervisory Board.As at December 31st 2015, one member of the Nomination and Remuneration Committee met the criteria of independence.

One of the key functions of the Nomination and Remuneration Committee is to propose Supervisory Board resolutions regarding changes in the composition of the Management Board and remuneration of the Management Board members. The Supervisory Board may assign other tasks to the Committee.

The Management Board of Pelion S.A.Supervisory Board

Created by John Pitcher